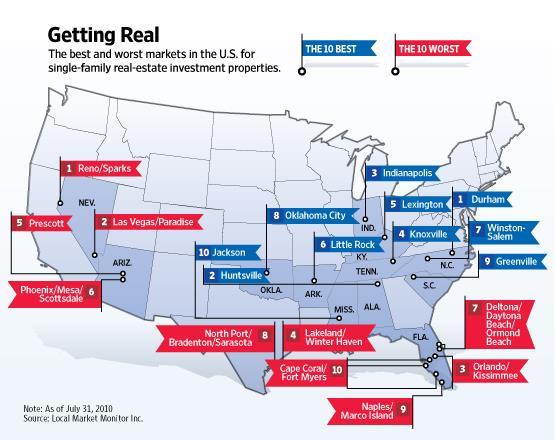

Hoamco, the managing HOA at Hassayampa Village in Prescott, AZ, announced today that two perspective buyers are in contract for the Golf Club in west Prescott.

Quoting Harvey Shrednick, president of Hoamco, “Based on a phone conversation with the Executive Vice President of Desert Troon, we were informed that the Golf Club has signed contracts with two prospective buyers, one with significant golf course management experience. Both potential buyers are completing extensive due diligence, with Desert Troon anticipating a Golf Club sale resolution within the next month. We will continue to keep you advised as more details become available.“

This news comes on the tail of a bankruptcy filed by Hassayampa Golf Club on March 30, 2012, in the Arizona Bankruptcy Court. The golf club was closed, and has sat vacant since, leaving homeowners and members with a bad taste in their mouth…but hopeful that a reputable company will see the value Hassayampa offers and purchase it.

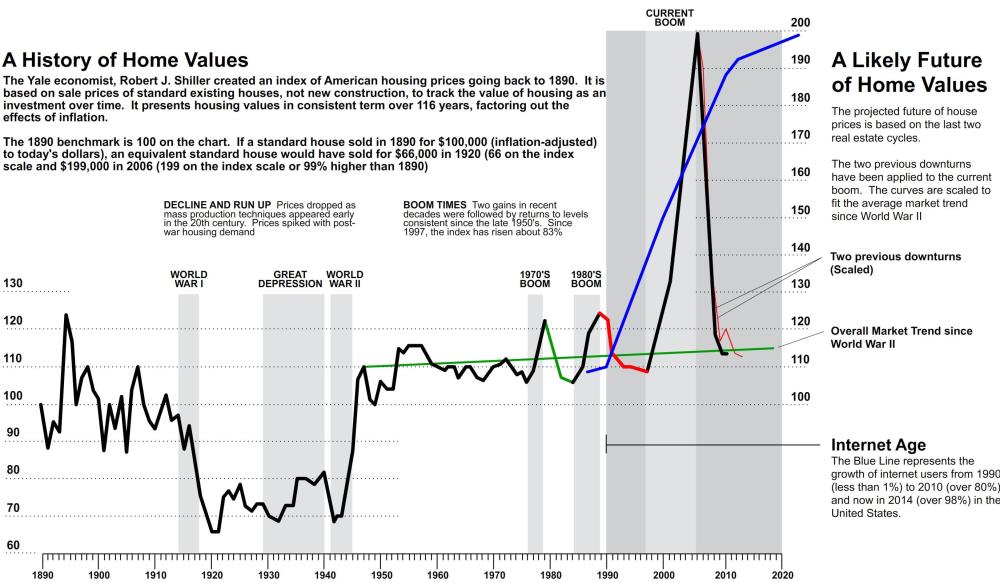

For homeowners and potential buyers, this could mean price hikes in the Village. The Hassayampa Village has always been a prestigeous location, but housing prices have definitely suffered from the closure of the golf club, club house, pool, and club amenities.

I held an open house during the annual Parade of Homes and had more than 50 people through the condo I have for sale. The single most asked question was “what do you know about the golf course reopening?” Because there is no definitive answer to this question, many home-seekers keep right on seeking.

As a result of this news, one of my listings has increased in price in the Hassayampa. I’m sure more will follow suit.

Hassayampa Village luxury golf homes for sale in Prescott, Arizona

© Matt White - REALTOR® |

© Matt White - REALTOR® |